Online Business Development

Advanced Market Risk Analysis

Revolutionizing Risk Analysis in Financial Markets

In today’s dynamic financial markets, accurate risk analysis plays a vital role in making informed investment decisions. The investment landscape poses several challenges that hinder investors from accessing comprehensive risk analysis reports for individual stocks and cryptocurrencies, conducting time-consuming research, and navigating complex tools. To address these challenges and provide investors with accurate risk analysis, a state-of-the-art web application was developed, leveraging cutting-edge technology and market analysis knowledge.

Client Challenges

The identified challenges in the investment landscape include:

Lack of Comprehensive Risk Analysis

Investors often struggle to access reliable and detailed risk analysis reports for individual stocks and cryptocurrencies, leading to uncertainty and potentially uninformed investment decisions.

Time-consuming Research

Conducting in-depth research on multiple symbols and coins to assess their risk profiles can be time-consuming and overwhelming for investors, hindering their ability to respond swiftly to market trends.

Limited Accessibility

Existing risk analysis tools may be complex or cater to seasoned professionals, creating a barrier for individual investors who seek user-friendly platforms with intuitive navigation and clear visuals.

Information Overload

The abundance of data and news sources in the financial markets can overwhelm investors, making it difficult to filter through the noise and extract relevant information for risk analysis. This challenge can lead to information overload and confusion, affecting investment decision-making.

Lack of Consolidated Platform

Investors often have to navigate multiple platforms and sources to gather risk analysis information, which can be time-consuming and inefficient. A lack of a consolidated platform that integrates various data sources and analysis tools hinders investors’ ability to streamline their research process.

Inadequate Risk Assessment Metrics

Existing risk analysis tools may rely on limited or outdated risk assessment metrics, failing to capture the full spectrum of risks associated with stocks and cryptocurrencies. This limitation can result in incomplete risk evaluations and potentially misleading insights for investors.

Complexity of Cryptocurrency Risk Analysis

Assessing risks in the cryptocurrency market presents unique challenges due to its volatile nature, regulatory uncertainties, and technological complexities. Many investors lack access to specialized risk analysis tools tailored specifically for cryptocurrencies, making it harder for them to navigate this emerging asset class.

Lack of Real-time Updates

Delayed or outdated risk analysis information can hinder investors’ ability to react quickly to changing market conditions and make informed investment decisions. Real-time updates on risk profiles are crucial for investors to stay ahead of market trends and mitigate potential risks.

The Solution

To address these challenges and provide investors with accurate risk analysis, a state-of-the-art web application was developed with the following key features:

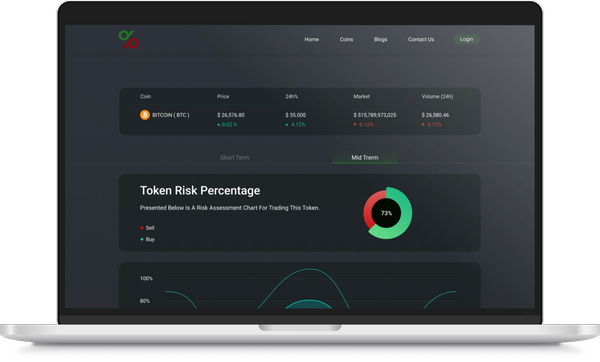

Real-time Risk Analysis

The web application utilizes specialized formulas and market analysis knowledge to generate real-time risk analysis reports for a wide range of stocks and cryptocurrencies, empowering users with timely and accurate insights.

Historical Data and Market Trends

The application incorporates historical data and current market trends, providing a comprehensive assessment of risks associated with buying or selling specific stocks or cryptocurrencies. Investors can gain valuable insights into the potential risks based on reliable and relevant information.

Customizable Alerts and Updates

Investors can save symbols of interest and receive regular updates on the risk status of those symbols. This feature ensures that users stay informed about potential changes in risk profiles, allowing them to make proactive investment decisions.

Trending Symbols and Coins

Users can explore trending symbols and coins, allowing them to identify investment opportunities and evaluate the associated risks. This feature enhances users’ ability to stay ahead of market trends and make well-informed decisions.

User-friendly Interface

The application offers a user-friendly and intuitive interface, making it accessible to investors of all levels of expertise. Easy navigation, clear visuals, and a simplified search function enable users to quickly find the symbols or coins they are interested in.

Integration of Economic Indicators

To enhance risk analysis accuracy, the application incorporates relevant economic indicators, such as interest rates, inflation rates, and geopolitical events. By considering macroeconomic factors, investors gain a holistic understanding of the risks associated with their investment choices.

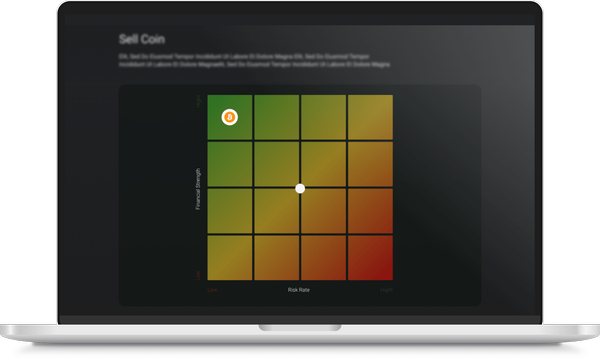

Machine Learning and Data Analytics

Sophisticated machine learning models and data analytics techniques are integrated into the application. These models analyze vast amounts of historical market data, including stock prices, trading volumes, news sentiment, and market indicators, to predict and quantify risks associated with specific stocks and cryptocurrencies.

Through the development of this technologically advanced web application, investors now have access to real-time risk analysis reports for stocks and cryptocurrencies. By integrating sophisticated risk prediction formulas, machine learning algorithms, and comprehensive data analysis, the application revolutionizes the investment decision-making process. Investors can navigate the complexities of the investment landscape with confidence, leveraging accurate risk assessments to make informed investment choices. This breakthrough in risk analysis technology marks a significant milestone in the financial industry, empowering investors to achieve their investment goals while managing risks effectively.